If you’re in the mortgage industry and you’re looking to increase mortgage leads then a really good conversion-focused mortgage landing page is exactly what you need.

That’s why this guide is all about building effective mortgage landing pages (or a mortgage lead funnel, as another way to think about it).

We’ll share some actionable strategies that you can implement today to get more (and better) mortgage leads.

Then we’ll dive into our of top five mortgage landing pages — showing you exactly what you can model.

Ready? Let’s go!

What is a Mortgage Landing Page?

A mortgage landing page is a web page where potential home buyers can go to request more info from a provider, when they are searching for something like a new mortgage, interest rates, or refinance of a mortgage.

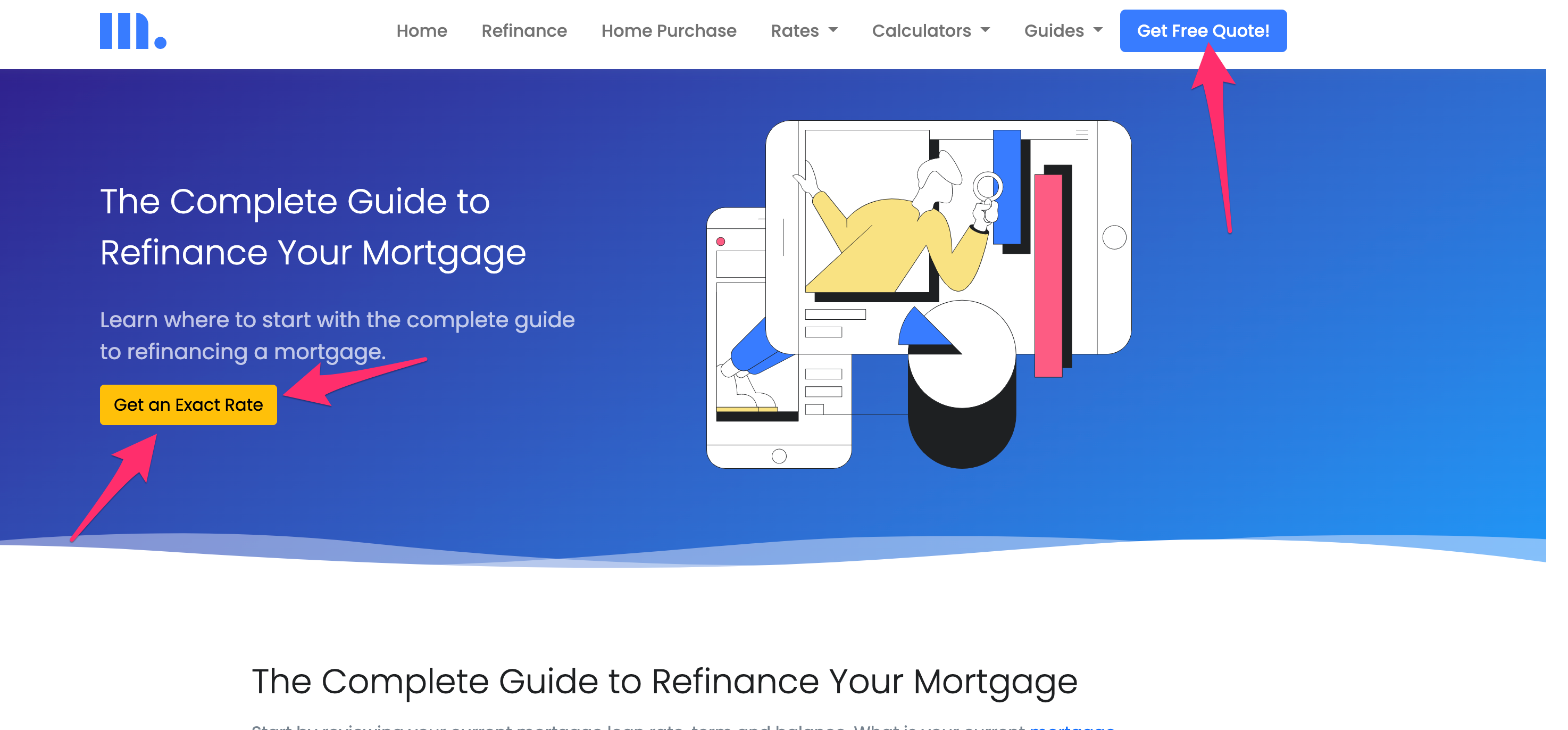

The landing page might look something like this:

The sole purpose of a mortgage landing page is to generate qualified mortgage leads.

The difference between your mortgage website and your landing page is that the website often has different call-to-actions and is less conversion focused. While on the flip side, the job of your landing page is to convert, and funnel (or segment) your prospects to your mortgage products and services.

This means that the mortgage landing page must be designed with conversion principles in mind and contain all the information needed for prospects who want to reach out for a rate quote.

When it comes to lead generation in general, especially for mortgage lead generation where the competition is fierce when it comes to online marketing, traffic is expensive, and the stakes are high, it’s really important to build a landing page that is going to convert, which is exactly what this post is going to help you do.

Why a Great Mortgage Landing Page Matters for Lead Generation?

A great mortgage lead capture page is the difference between generating a huge pipeline of leads and having no leads at all.

Here are a few reasons why your landing page matters:

1) Helps your prospect understand what you offer

First, a great mortgage landing page helps to quickly inform the potential borrowers about the products and services offered by a mortgage lender.

2) Increases overall conversions and leads

Second, dedicated mortgage landing pages are a great way to increase your overall traffic conversion rate. The average mortgage website converts around < 2% of website visitors into leads.

While a typical landing page converts 3-5X higher. This means that you can increase leads and get a better ROI on your digital marketing efforts.

3) Helps you get qualified leads, which you can segment in your CRM/database

Third, if the mortgage landing page is setup the right way with a high converting mortgage leadform, then it gives you a way to pre-qualify leads so your loan officer and sales team don’t waste time with bad leads.

4) It’s the quickest path into your sales process

Finally, your landing page acts as the bridge between your website and your sales process. It gives your potential borrower a very easy, straight-forward way to get in touch with you.

If your landing page is setup the right way, then the prospect will know exactly what to do the moment that they land on your page, and you won’t have to worry about them getting lost or confused in the process — something that typically happens when you send prospects to the primary home page of a website.

The bottom line — if you’re spending money on any form of advertising, or even SEO to help generate mortgage leads then creating a high converting landing page can help you take things to the next level.

What to Include on a Mortgage Landing Page?

Before we get into some examples of really good mortgage landing pages, let’s talk about what you should include in your landing page to begin with.

First, when it comes to conversion there are typically a number of factors that influence a page’s ability to convert.

You can use these factors to evaluate landing pages from the perspective of the page visitor to determine if the page is likely to convert

The Top 5 Conversion Factors:

1) Value Proposition:

Value Proposition in Marketing is the core message that your company offers to potential customers. A very simple way to think about your value prop is to think about what your mortgage company offers that others don’t offer. Your value proposition should be clear and easy to understand on your landing page.

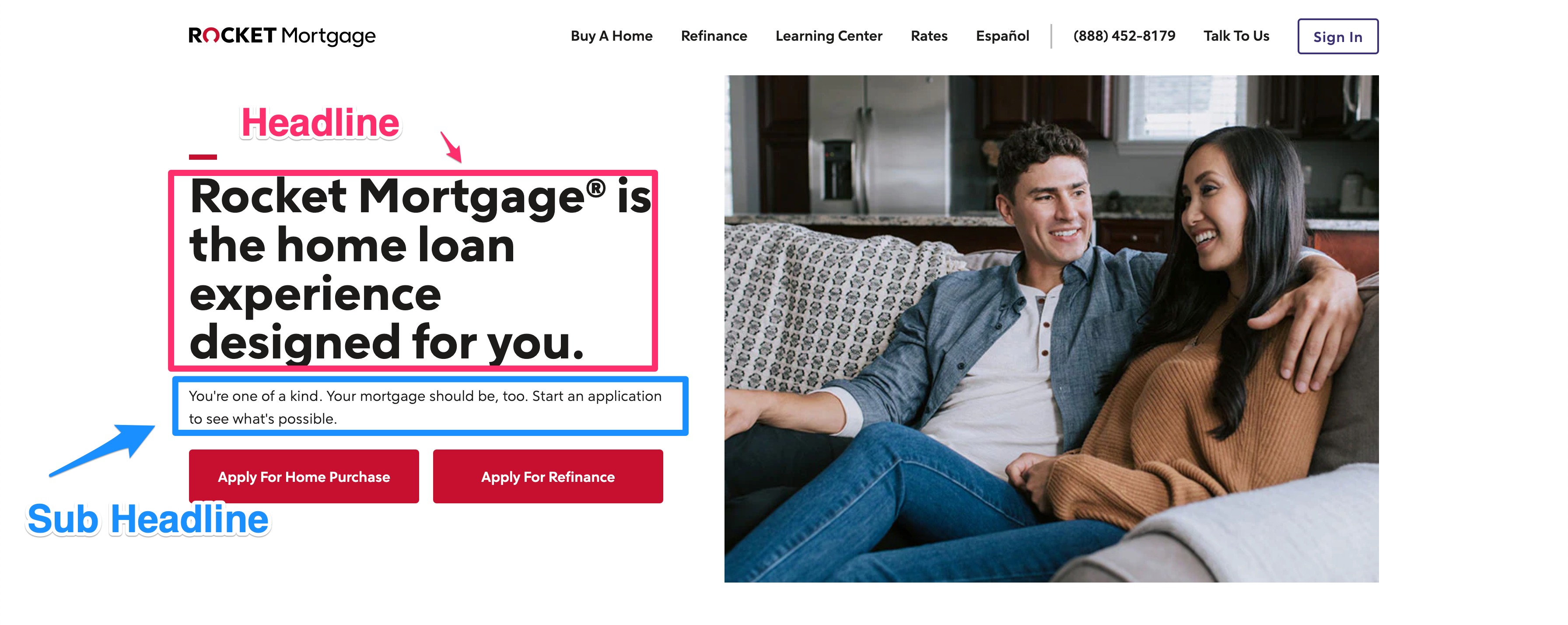

Here’s a great example of Rocket Mortgage’s Value Prop: ‘the home loan experienced designed for you’

2) Relevance:

Does your web page relate to what your visitor thought they were going to see? If your website visitor hits your landing page thinking that you offer the ability to refinance their mortgage and all you talk about is getting a new mortgage, then the landing page will suffer in the relevance category and have a lower conversion rate.

3) Clarity:

Does your web pages clearly explain your value proposition and have easy-to-find CTAs? Design and content are the two most important aspects of clarity. If your content is all over the place, then it will be hard for the prospect to understand what you offer. When it comes to clarity, your landing page should be extremely simple to understand and consume.

Here’s a great example of a page that’s clear and has call-to-actions that are straight forward and easy to find.

4) Urgency:

Using urgency in your landing pages can be a great way to drive the prospect to take action. In some cases, especially when it comes to a mortgage, the potential borrower may have a sense of urgency to get a deal done soon. You can play into this by making special offers with deadlines attached.

5) Anxiety & Distraction:

This is one of the biggest conversion inhibitors and outside of clarity, one of the biggest things that marketers struggle with most when it comes to your landing pages. Even something as simple as those trust and security badges can work against you and create a sense of anxiety that causes the prospect to think twice before submitting your contact form.

When creating your mortgage landing page, try putting yourself in your prospect’s shoes. What are those things that you could be saying or doing that could drive them away?

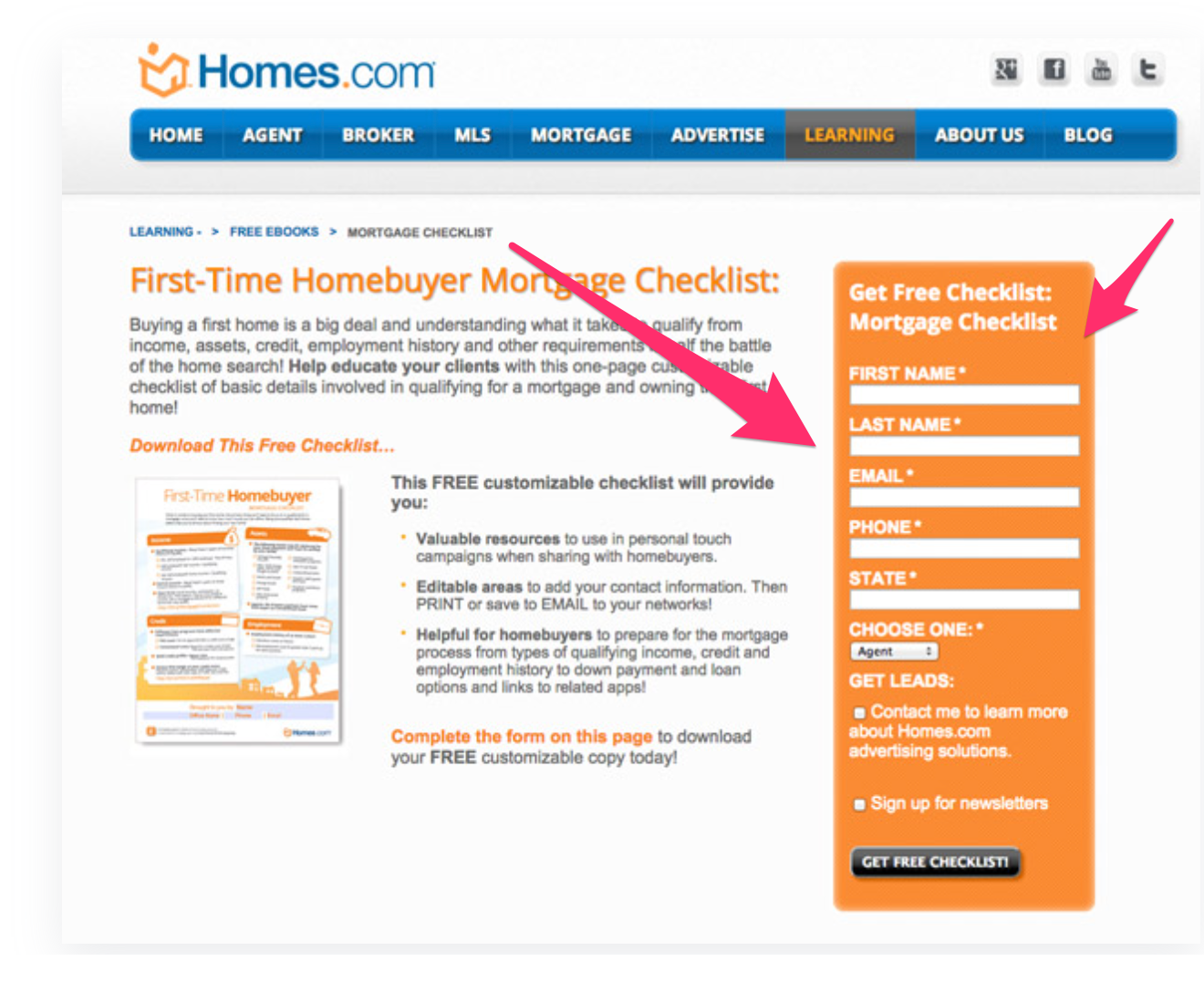

Pro tip: Do you know what one of the biggest elements on a landing page is that causes the most anxiety? If you guessed the form then you nailed it!

Do you get any anxiety from looking at that long form above? We sure do!

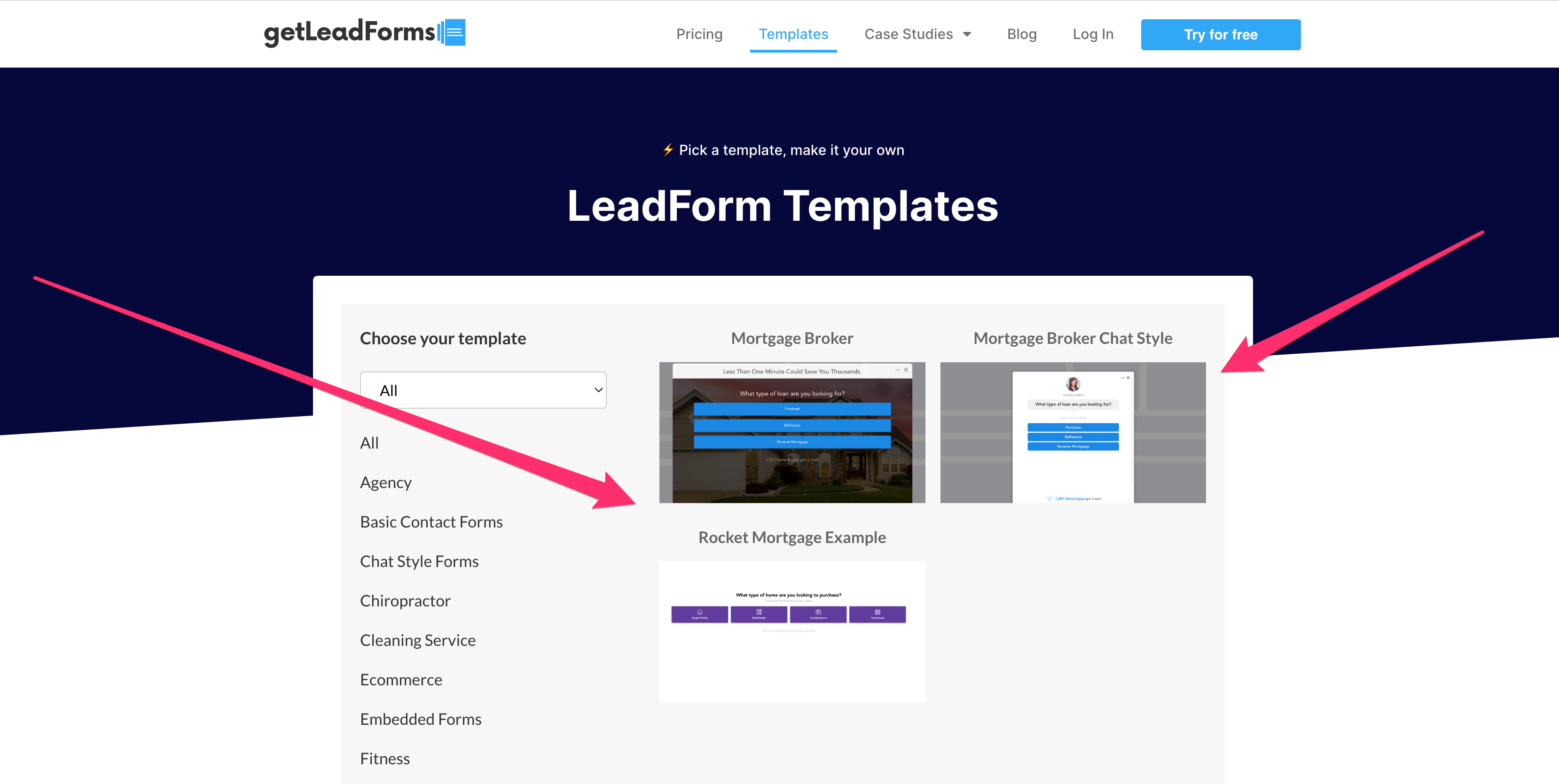

For help creating more-user friendly, multi step mortgage forms check out some of these templates.

When it comes to generating quality, data rich mortgage leads, you’re in a tough position. On the one hand, you need quite a few details about your prospect so you can pre-qualify them. On the other hand, the prospect barely knows you and isn’t always ready to part with their valuable data.

So, how do you help ease the anxiety around submitting your form? One of the keys is to break your long-form up into multiple questions using a user-friendly multi-step form like this:

You can see the above Rocket Mortgage inspired lead form right here.

Now let’s look at what you should include on your mortgage landing page to help drive conversion.

- Headline: The headline is one of the most important elements on any mortgage landing page because it’s the first thing that your prospect sees. A great landing page should be relevant and clear, so that the prospect knows that they are in the right place.

- Sub headline: The job of the subhead is to support the headline of the landing page. Sub headlines are used to highlight specific features or benefits of the product/service being offered. They should be simple, short and compelling. However, they must not overwhelm the main headline.

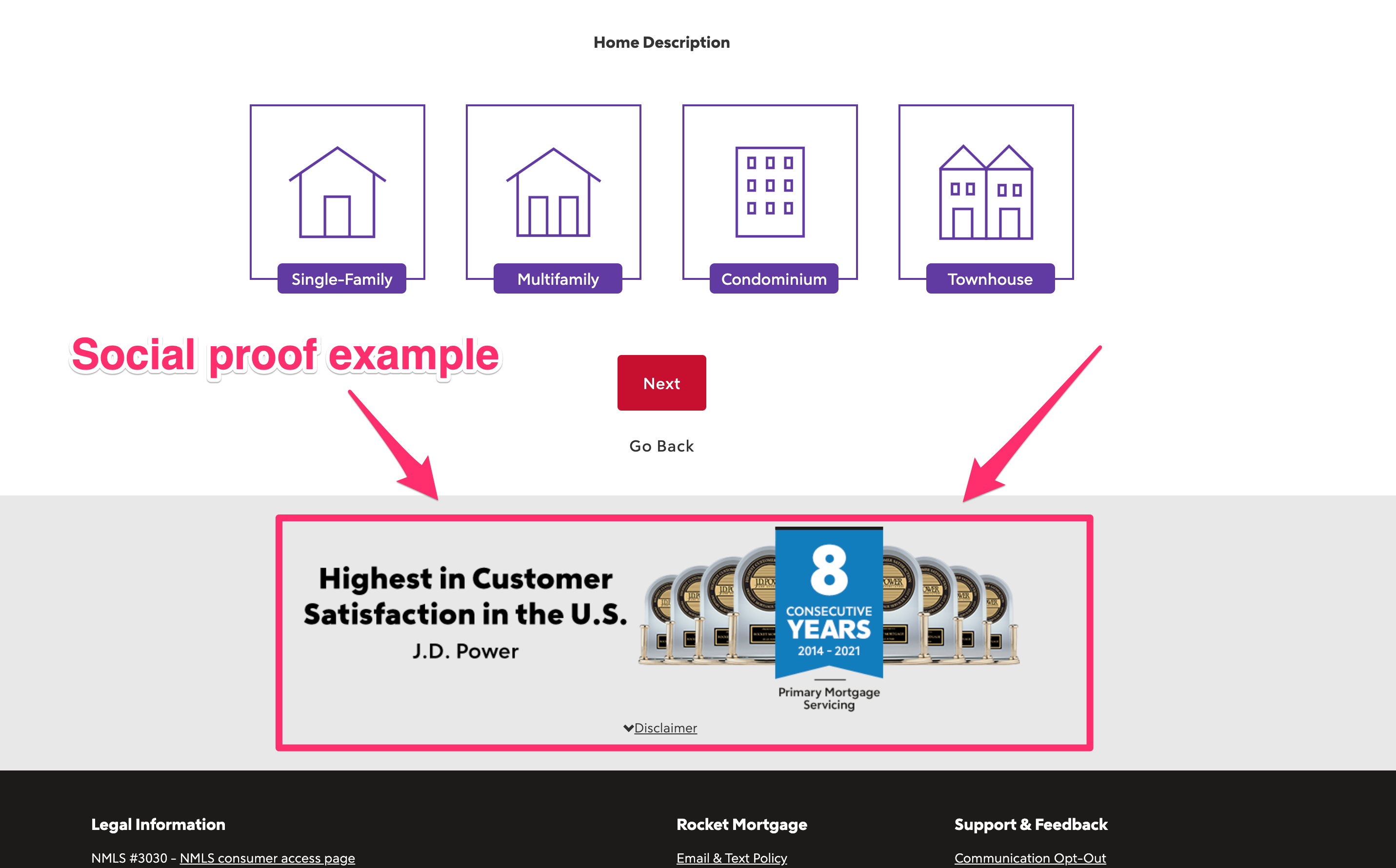

- Social Proof: It has been proven that people are more likely to act or behave in a certain way if they know that others are behaving similarly. In fact, 83% of consumers say recommendations make them more likely to purchase a product or service. For that reason, it’s always worth providing social proof on your landing page. Social proof can come in the form of testimonials, publications where your mortgage company has been featured, awards, and more.

Pro Tip: Try strategically placing your social proof near your CTAs and headlines to boost conversion.

- Supporting Content (that’s also relevant): Don’t forget the content! The good news is that since the best landing pages are often short and simple, you probably don’t need a whole ton of content. The key is to have content that matches what the prospect is looking for. If your prospect is looking for a mortgage then your landing page should talk about that. If the prospect is looking to refinance, then your page should talk about the services that you provide related to refi. There are even ways to dynamically match the content to what the person is searching for. For example, if you’re using WordPess then we built a plugin to help serve up dynamic content on landing pages .

- Multi Step LeadForm: Finally, every great mortgage landing page needs a form. But not just any form, we always suggest using a multi step form. By breaking your questions up into multiple steps, you can get more data about your leads while also providing your prospect with a nice user experience.

Check out the template above here.

That’s pretty much it.

Now let’s jump into some examples.

Examples of High Converting Mortgage Landing Pages

The examples below will help give you some great mortgage landing page ideas that you can model for your inbound lead generation efforts.

1. Rocket Mortgage’s Landing Page

The thing that we love about RocketMortgage’s page is how simple it is. While the headline is a bit wordy, it does offer a value prop that’s different than what most competitors are saying and could be very compelling to their audience: ‘a home loan experience designed for you’.

Rocket Mortgage does a great job strategically placing their CTA’s above the fold, and using the call-to-actions to funnel people to the appropriate form.

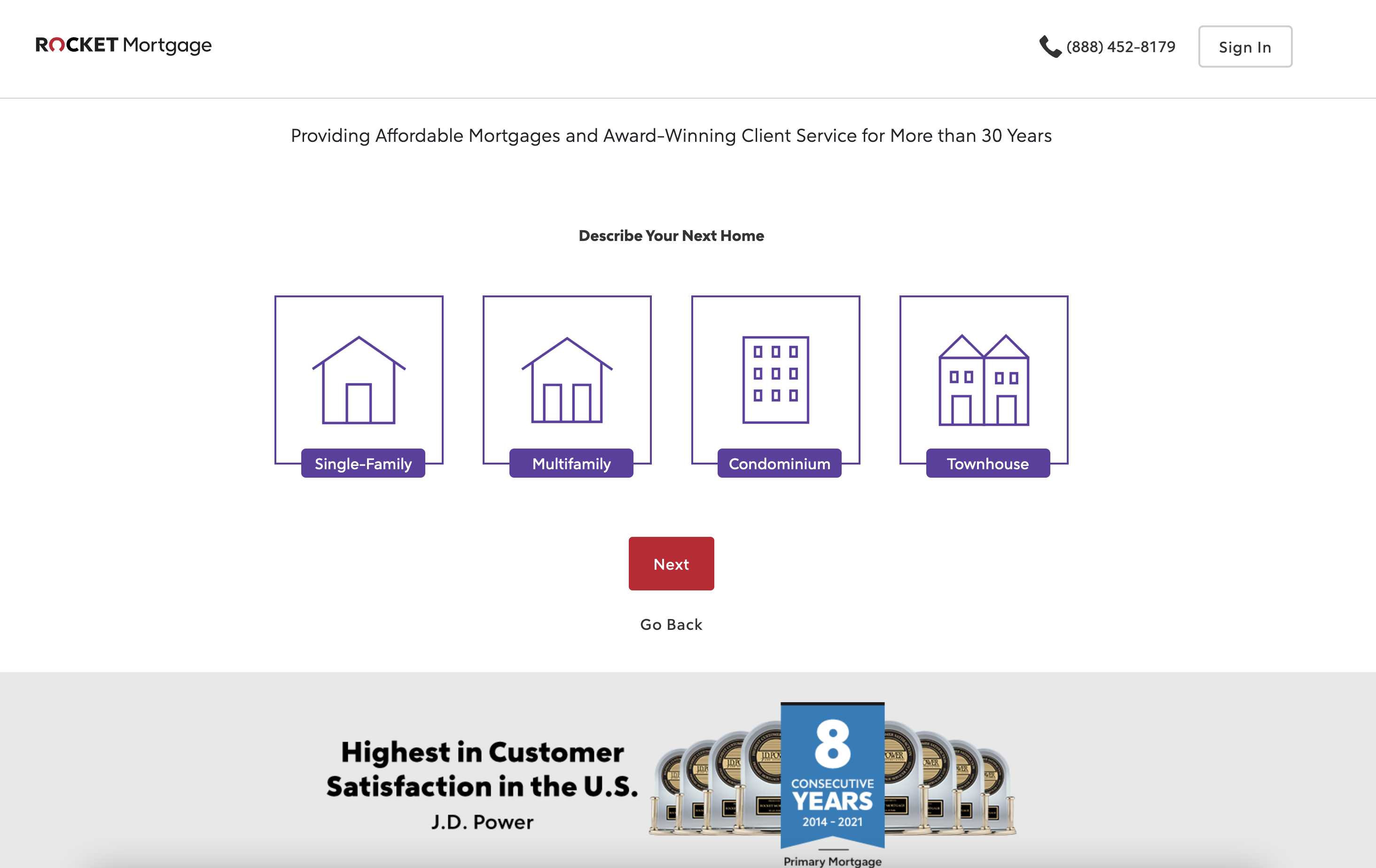

When you click on one of the buttons above, you are directed to a multi step form to help the prospect find a good mortgage rate.

For example, if you click ‘apply for a Refinance’ then you are taking to their refinance landing page.

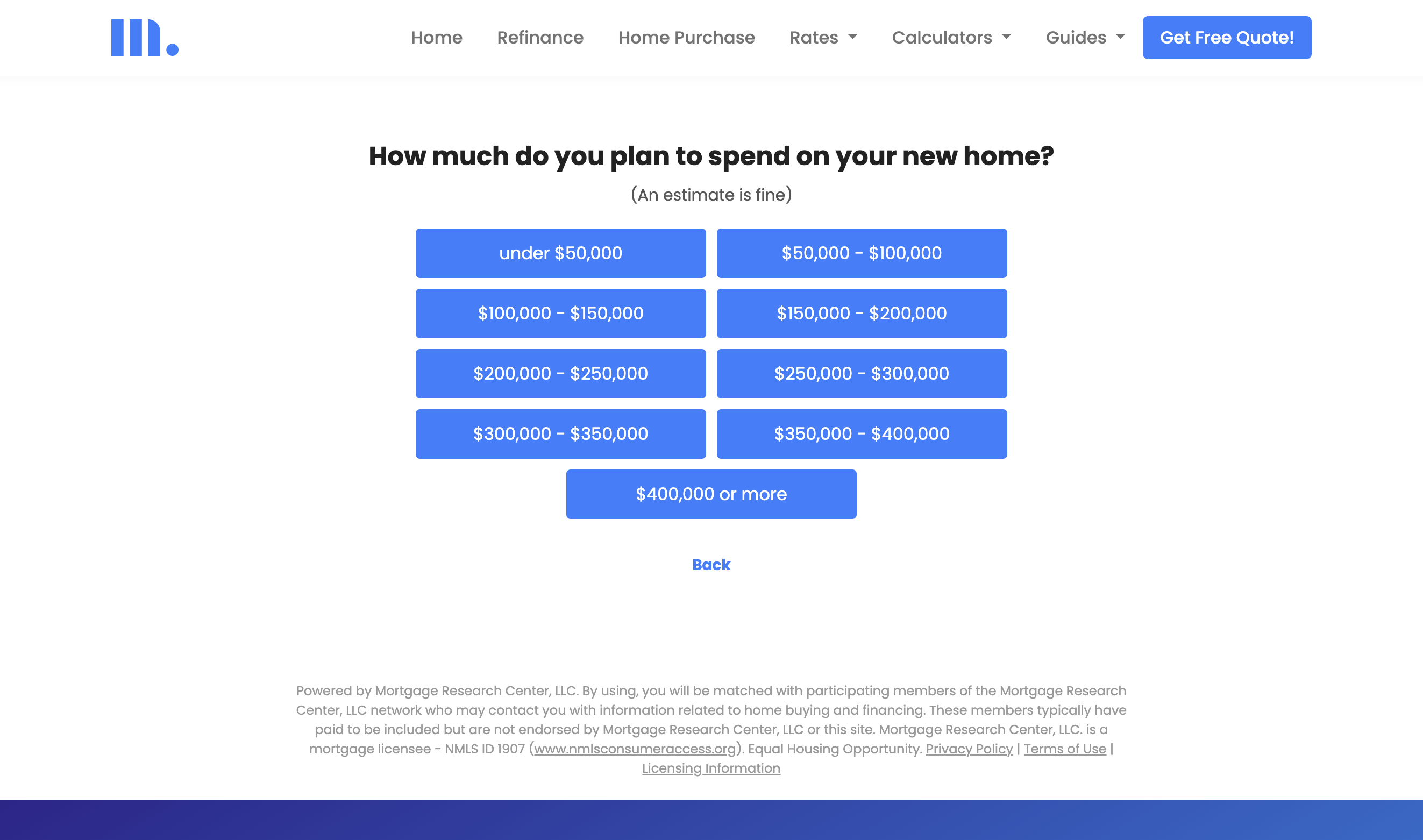

And if you click on ‘apply for a home purchase’ you are taken to their home purchase landing page like this:

Rocket Mortgage’s multi step mortgage form is nicely designed and extremely easy to use. They do a great job making it easy to know exactly which items to select by using big icons.

Also, notice how they have their customer satisfaction awards right below the form. This is a very smart move, which probably boosts conversions by making prospects more compelled to part with their contact info.

Want a multi step lead form like the one that Rocket Mortgage is using? Here’s a customizable template that we built for you. Simply swipe this template and set it up inside of GetLeadForms.

Grab this Rocket Mortgage Inspired multi step form template here.

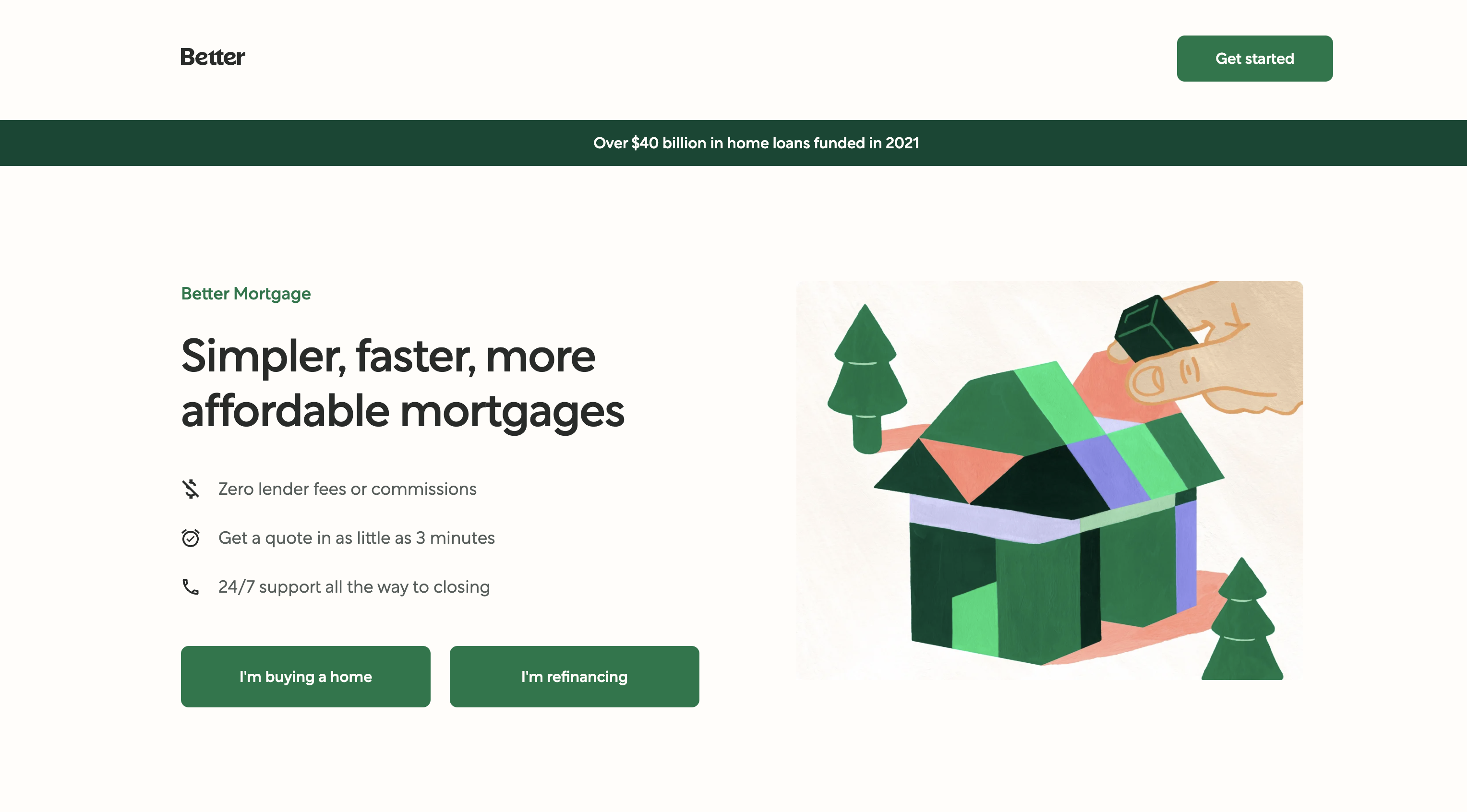

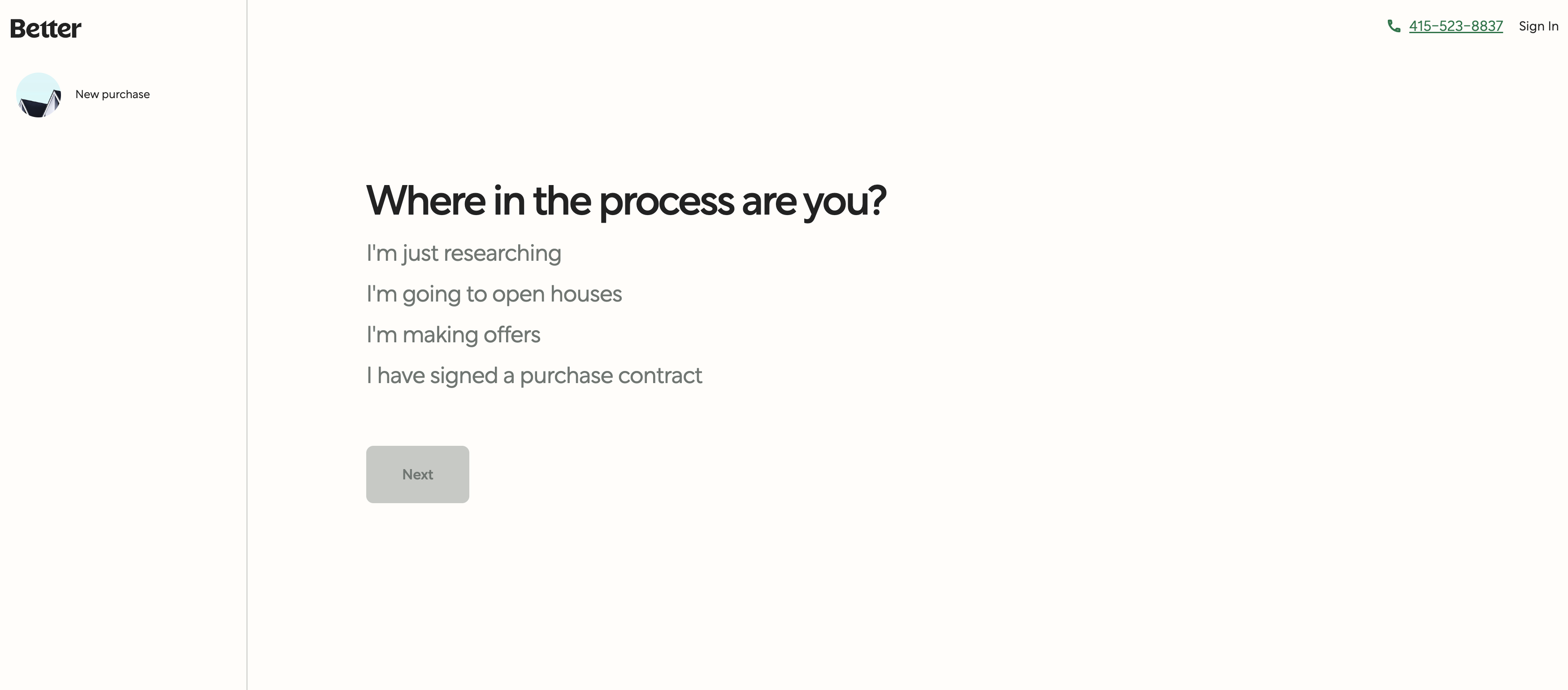

2. Better.com’s Mortgage Landing Page

Remember in the sections above when we explained how it’s important to keep your landing page super simple and to the point? Well Better.com does a great job of this with their landing page.

Better.com leads in with a very compelling value prop and benefit driven copy to support the value prop.

From there, they do a great job of segmenting prospects into one of two buckets. Either prospects looking for a mortgage to buy a home, or people who are looking to refinance. After you click one of the buttons above, you are directed to a multi step form to provide more info.

The above is an example of Better’s multi step form to qualify mortgage leads. They start out with a simple question then ask more questions after the next button is clicked. These types of forms work especially well for all of those savvy interest rate shoppers out there.

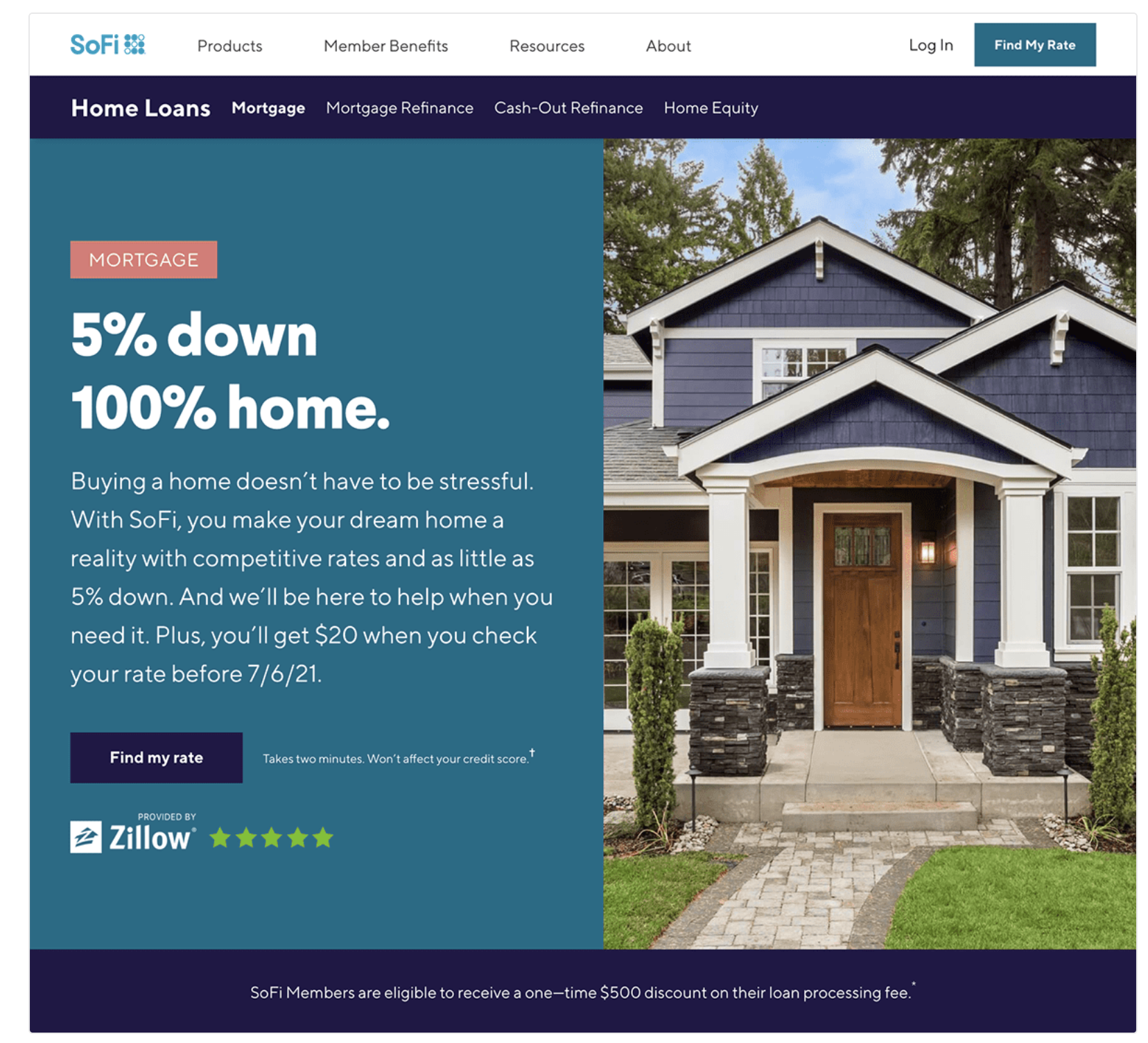

3. Sofi’s Mortgage Landing Page

Here’s an excellent mortgage landing page example to prove that finance-related topics aren’t always boring.

SoFi uses a catchy headline to grab someone’s attention right away. They promise to solve a customer’s pain point by helping them get a mortgage without hassle and hidden fees.

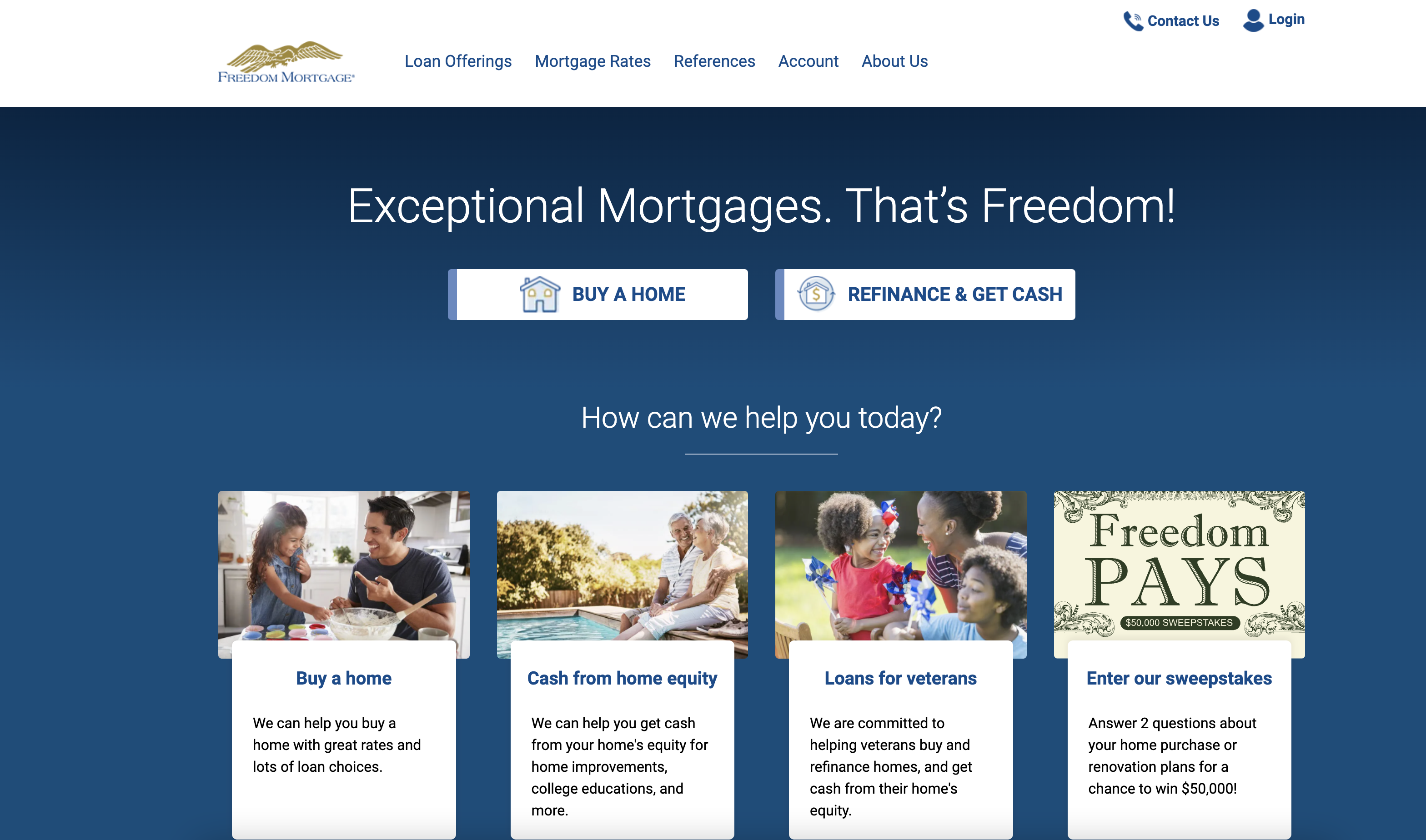

4. Freedom Mortgage Landing Page

This landing page by Freedom Mortgage may seem simple, but that’s what makes it great.

Our favorite part about the landing page is how Freedom Mortgage gets right to the point so a potential borrower knows exactly what to do.

As soon as the page loads you see a big headline and two big Call-to-actions to send you down the appropriate path. The only thing that they could do better is to reduce the number of clicks it takes to get to their form (it takes about 3) by having a multi step form open right on their page.

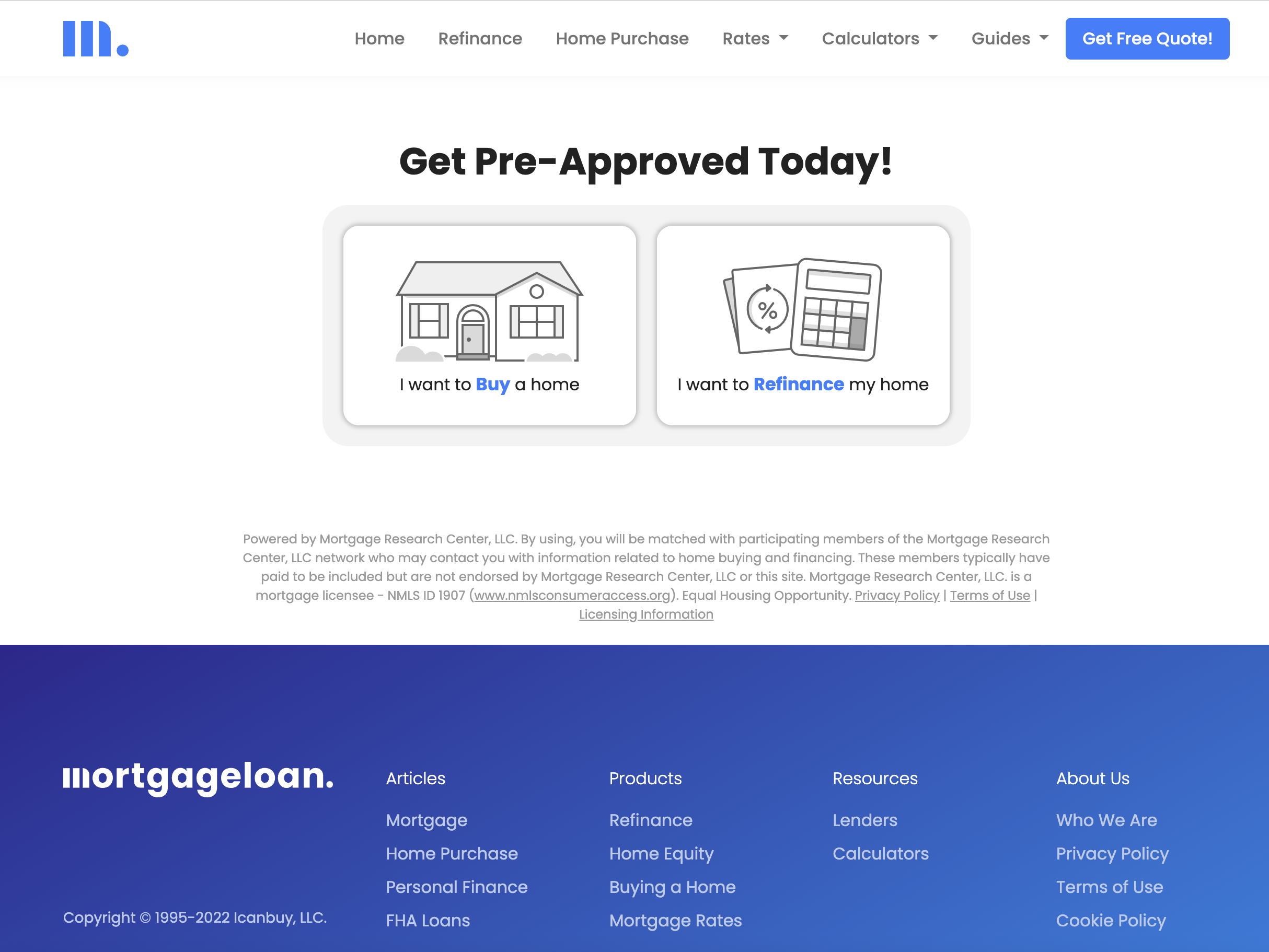

5. Mortgageloan’s Landing Page

This is by far one of our favorite designs — it is super slick, simple, and engaging.

What we like the most about this landing page is the use of the multi step mortgage form and how Mortgageloan makes it very easy to complete the form.

Here’s step two of the form:

As you can see, depending upon what path you go down from the start, they begin to ask additional qualifying questions. They also give you the option to go back, in case you went down the wrong path.

Your Lead Capture Form is Everything When it Comes to Getting You the Highest Converting Mortgage Leads

One of the common things between all of the examples above is that all of these companies put a big emphasis on the web form, or lead generation form.

And that makes sense, because when it comes to lead generation or lead capture in the mortgage space, your web form is everything.

In fact, here are some benefits of having a really good mortgage lead form:

- More qualified leads: A good lead form has a high conversion rate, but a great lead form has both a high conversion rate and gets you qualified leads. The benefits of getting more qualified mortgage leads is that it takes the burden off of your loan officers or sales team to get every single piece of info, especially the type of stuff that can just as easily be provided upfront. It also makes it easier to know which leads to follow-up with and which leads are not qualified.

- Better segmentation of leads: Times are changing and the days of blasting out sales messages to your entire list of leads without any regard for segmentation have come to an end. This is not only annoys customers, but it also make it hard to get good deliverability of your marketing emails. By getting better data about your leads, you can segment leads into your CRMs so you’re saying the right things to the right audience at the right time.

- Increased conversions for your landing page: Last but not least, at the end of the day a great lead form that’s built to convert is going to lift up your total landing page conversion rate and improve your overall online marketing ROI.

Here’s an example of a great lead form that can be used for any type of mortgage provider that’s looking to generated qualified opt-in mortgage leads.

As you can see, this lead form is broken up into multi steps with different paths. This way the prospect can select the product that they are looking for and then the form takes care of the rest, keeping them engaged in a fun, interactive way before asking the prospect for their contact details.

This LeadForm was built in GetLeadForms. You can view this lead form and some other templates like it right here.

Whatever you do, don’t make the mistake of investing a ton of time and effort into your landing page then neglect your form. A great LeadForm is often a game-changer when it comes to boosting your conversion rates.

Tools for Building and Optimizing a High Converting Mortgage Landing Page

Finally, let’s wrap this up with some of our favorite tools to help you in your journey of building and optimizing high converting landing pages

- Multi Step Forms: GetLeadForms — Obviously we’re a bit biased here — GetLeadForms will help you build the type of multi step forms that you see in the examples throughout this post. You can easily create very user-friendly high converting mortgage lead forms, mortgage funnels, and even real-estate forms using GetLeadForms. Start your free trial.

- Landing Pages: Our favorite options for quickly building a landing page without code are Unbounce, Leadpages, or Instapage. WordPress can also work great for landing pages depending upon your theme and wordpress setup. After you get your landing page setup, you can easily drop your multi step lead form right into your landing page.

- Content Personalization: If you’re looking to streamline management of your landing pages and dynamically update your pages to match what your mortgage prospect is using, then here’s a simple plugin that we built to help.

- CRO Tools: We always like the say that the real-work of optimizing your landing page starts after you launch! For this reason, we suggest using CRO tools to analyze and A/B test your page after you launch. Some great tools are HotJar, LuckyOrange, and Google Optimize.

- Compliance: If you’re generating inbound mortgage leads or real-estate leads that you’re either selling to a lead buyer such as Realtor.com or LendingTree, or if you’re planning to reach out to your leads either through phone or SMS, then I highly recommend capturing proof of consent with each lead to mitigate the risk of TCPA litigation. This where our ActiveProspect TrustedForm Integration will help.

Final Thoughts and What to do Next

This wraps up our post about high converting mortgage lead capture pages.

Throughout this post, we gave you some practical tips that you can start using as soon as today.

And we shared some examples of our very favorite mortgage landing pages that we see out there in the industry.

For help capturing more qualified mortgage leads, grab a free trial of GetLeadForms here.

Explore some of our mortgage lead form templates here.