Zillow has carved a name in the real estate industry.

Great for them! But as a mortgage marketer or lender, you might feel like it’s the “big bad wolf” that steals potential mortgage leads.

No matter how you feel, it’s hard to deny that Zillow is doing something right.

Zillow’s online lead-generation game is top-tier. That’s why it attracts high-quality mortgage leads. And there’s a lesson or two you can get from it.

In this post, I will reveal one of Zillow’s best strategies. And to give you a clue – it’s connected to a simple landing page.

I’ll also guide you on using Zillow’s exact same lead capture strategy on your own website.

Ready? Let’s go!

How Zillow captures more leads with a “How much is my home worth?” quiz

Let me break down Zillow’s home valuation landing page.

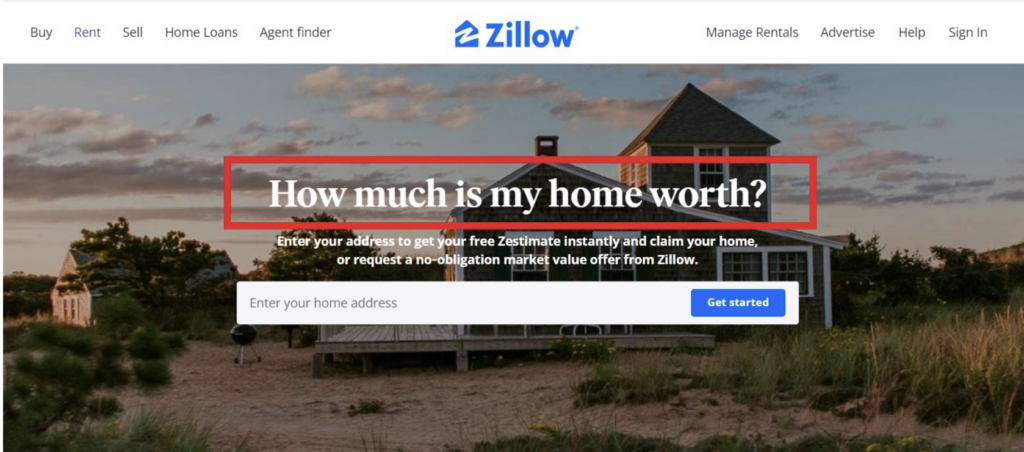

First, they’ve got this on-point headline: “How much is my home worth?”

It’s a brilliant headline because it cuts right to the chase. It also shows that Zillow understands what visitors want to know.

The best mortgage landing pages follow this pattern. They prioritize clarity over fluff.

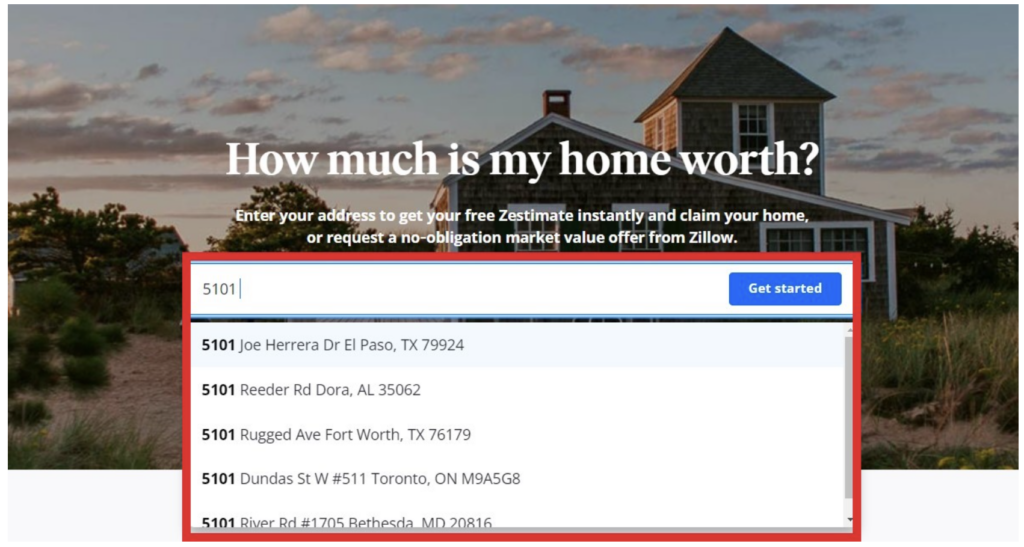

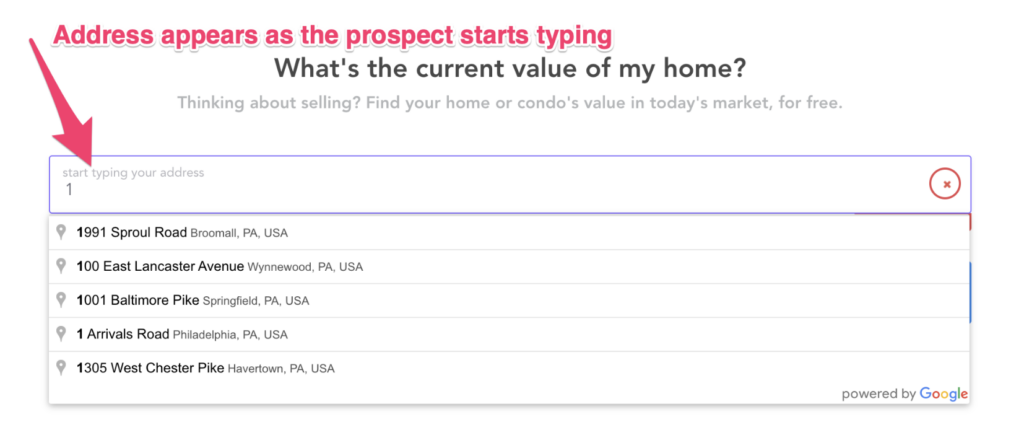

Next, as prospects type in their address, they’ll notice an autocomplete feature.

This tool provides a more frictionless experience for the user.

Predicting and filling out the address removes the tedious task of entering every detail. And because of the faster and smoother process, your visitors will likely continue.

Now, for the main event.

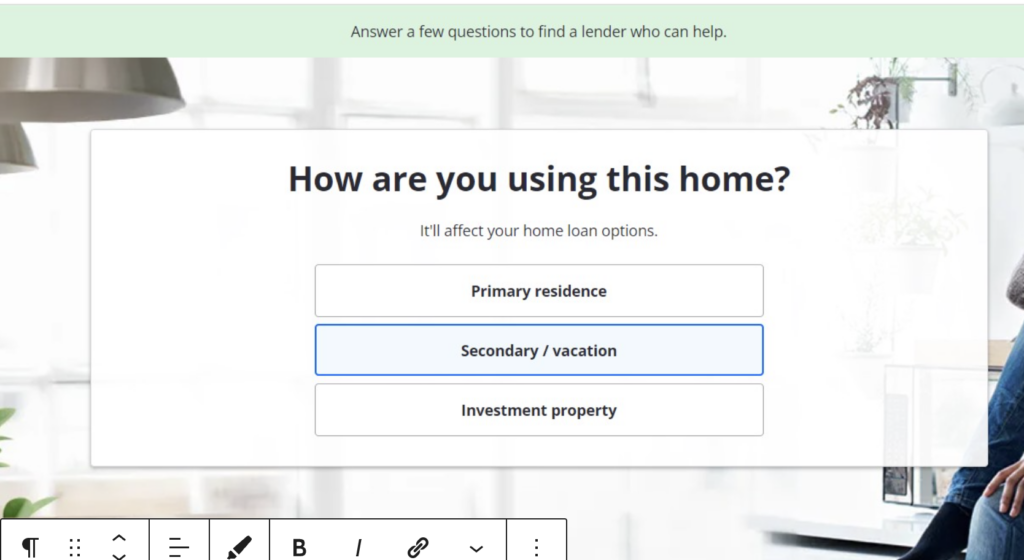

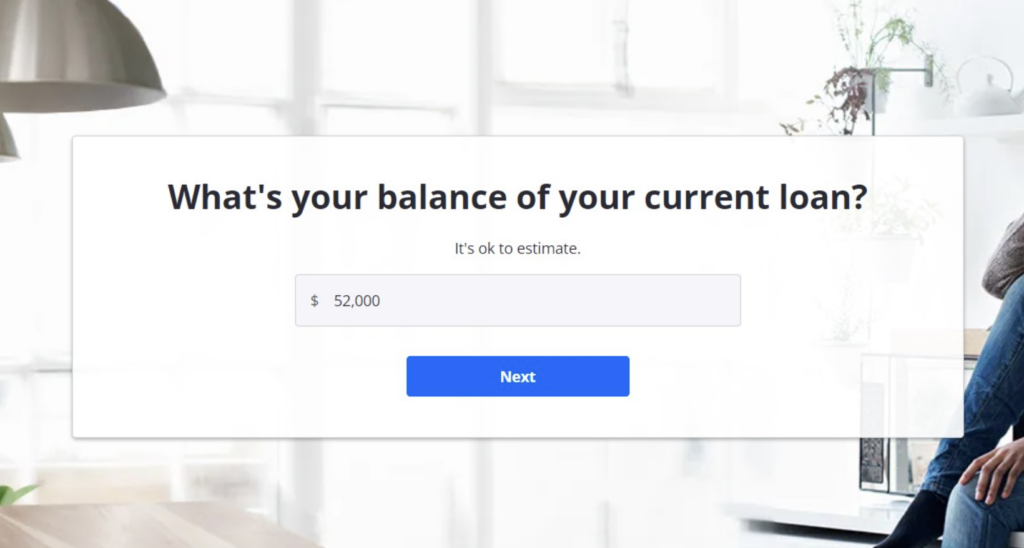

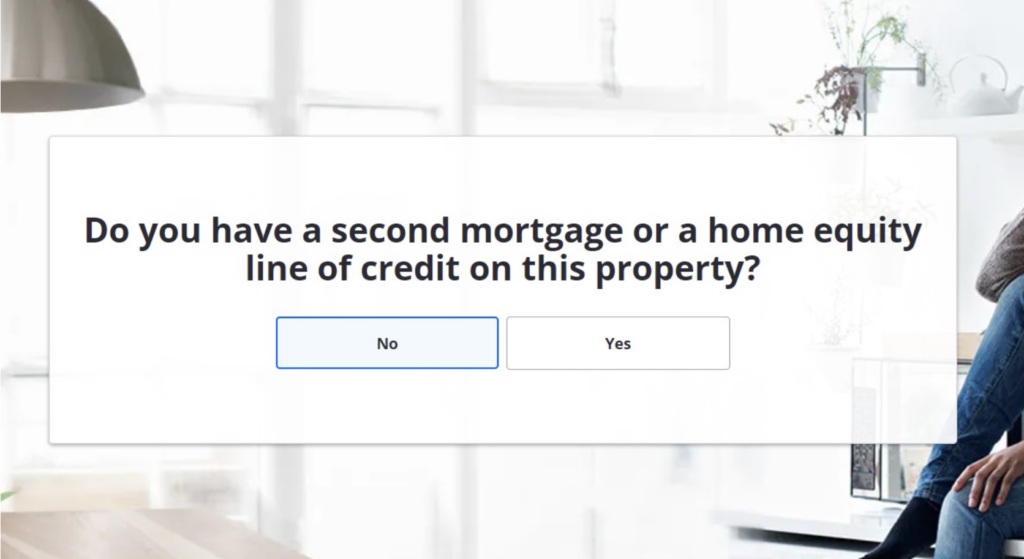

Zillow uses a multi-step form in its home value estimator widget to pre-qualify its leads. It’s available once the visitor clicks “Start Now.”

Zillow then asks questions to help you estimate your home equity. Here are some examples:

- Your property’s purpose

- Your loan balance

- Any other existing mortgage or HELOC

Zillow designed the process intuitively to ensure leads are inclined to fill out the home valuation form.

These questions are not just for Zillow to gather data – they’re strategic.

By prompting prospects to reflect on these details, they’re already engaging them in a conversation about their property’s value.

What makes it effective is it offers an advantage on both sides.

For homeowners, it’s their first glimpse into what their property could be worth. This gets them thinking about ways to use their home equity.

Meanwhile, it works like a filter for mortgage lenders and marketers like you.

Instead of swimming in an ocean of maybe-this and maybe-that leads, you get a list of serious homebuyer leads.

They’ve put in the effort, engaged, and are likely closer to moving on to the next step.

Note: Do you want to create something like this but without the hassle? We’ve got the perfect tool for you. Capture and convert leads effortlessly with our optimized mortgage home valuation survey. Check it out.

What are the benefits of using online home valuations to attract more seller leads?

Adding a home valuation landing page on your site opens many doors. Here’s why:

- Caters to Curiosity. At some point, homeowners get curious about their home’s value. With this tool, you’re catching those potential leads right at the peak of their interest.

- Expands Your Reach. The mortgage world is vast, and competition is stiff. But by allowing potential leads to estimate their home’s worth, you’re providing a valuable service and building a database. This is useful for future marketing campaigns.

- Provides Invaluable Data. For you, understanding a lead’s financial position is everything. The more data you can get about them, the better you can tailor your services.

- Opens Cross-Selling Opportunities. Besides the primary mortgage, you can also understand your lead’s equity position. This allows you to offer loan products that might be beneficial for them. Home improvement loans, debt consolidation options – the list goes on.

So, to stay ahead of the curve, consider adding this lead capture tool to capture more mortgage leads.

How to build a home valuation landing page like Zillow to capture more mortgage leads

Now that we discussed how Zillow captures more mortgage leads with a home valuation quiz, let me show you exactly how to add one to your own mortgage landing page or website.

Step 1: Create a simple: “what’s my home worth” landing page

I like Zillow’s landing page because it’s simple. It’s not feeding visitors with too much information or graphics.

You’ll only see a clear headline, the primary tool, and a FAQs list.

When crafting your own, remember to use a clean layout, a few relevant images, and concise copy.

You can aim for 250 to 300 words of well-structured, informative content. As for images, 2-3 high-quality visuals that complement the copy and don’t clutter the page should do the trick.

Also, make sure to add the free home valuation widget for the website at the top of your page.

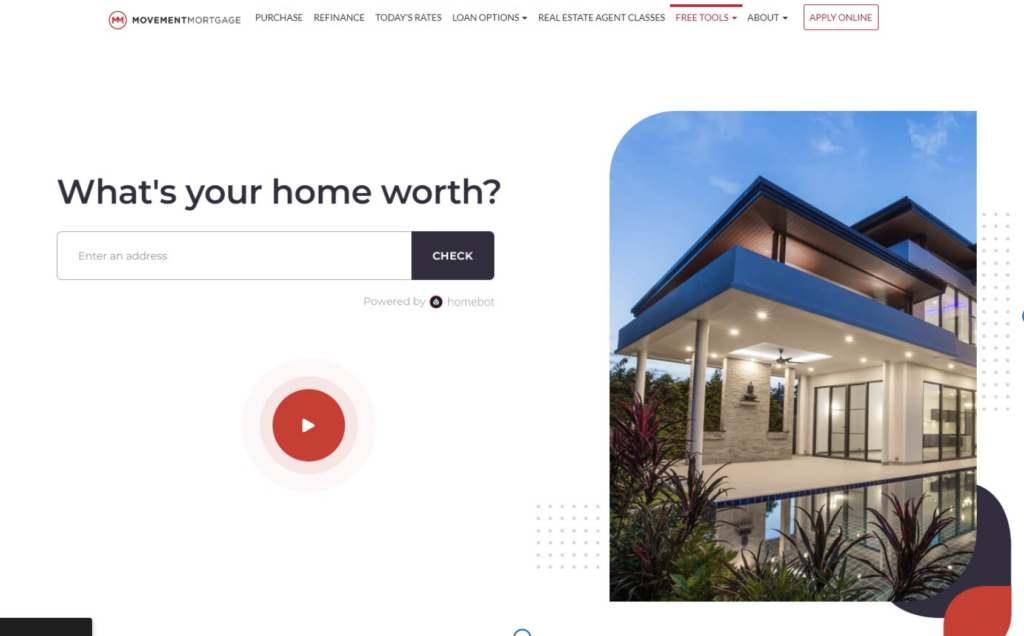

To better understand how to approach this, here’s an example from a great mortgage sites with a home valuation: Movement Mortgage.

Notice how simple this page is.

Like Zillow, Movement Mortgage keeps the prospect focused on completing the form to get a free home valuation report.

Step 2: Create your home valuation survey

Now that you have a sleek landing page up and running, let’s dive into the highlight of the process – the survey.

This is where you’ll capture those valuable leads and truly understand their needs.

The good news is that building it is much easier than it sounds. You don’t have to create something similar to Zillow or start from scratch.

You’ve got many options, with several services offering free home valuation widgets for mortgage websites. But for this guide’s sake, I’ll focus on setting one up using GetLeadForms.

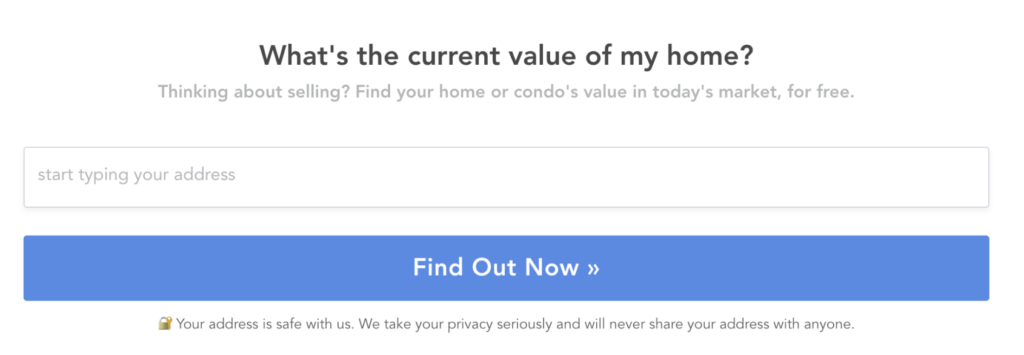

Here’s the exact template I’ll use for this example:

Begin with the home address

It might sound basic, but this initial step is crucial to your entire lead qualification process.

By requesting the prospect’s home address right off the bat, you’re setting the stage for a deeper, more personalized interaction.

Here’s why asking for the home address is so important:

- It’s a strong starting point. More than being basic information, the home address is a crucial data point as it guides the rest of the survey and the valuation.

- Sign of a genuine lead. By willingly providing their address, the prospect is giving you a direct indication that they’re serious. This isn’t just some curious browser; this is someone genuinely interested in discovering their home’s value. Hence, they instantly become a high-quality mortgage lead for you.

- Great commitment indicator. Visitors who’ve taken that initial step are more inclined to see the process through to the end. They’re more likely to make a purchase—or, in this case, complete the survey.

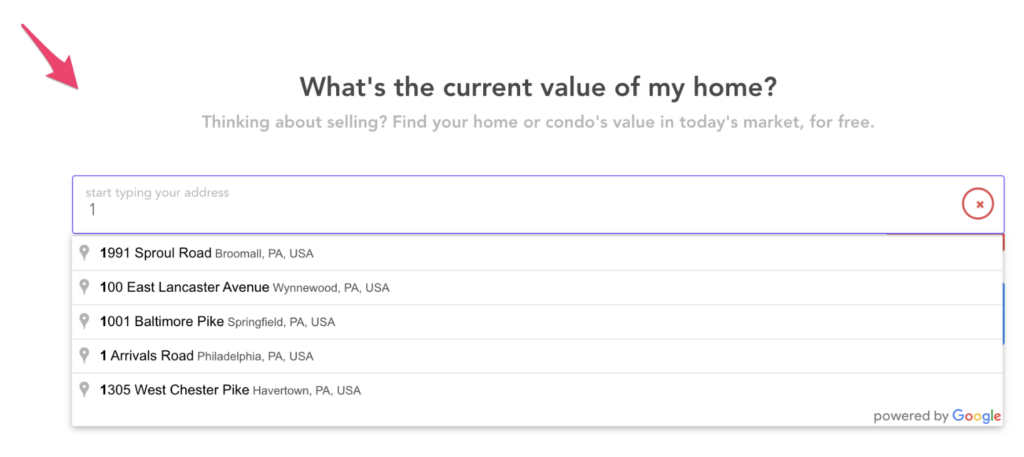

Besides that, here’s another pro tip for you. If you want to improve user experience and reduce friction, give the Google Address auto-complete feature a shot.

I’ve thrown it into the home valuation tool for my website and other forms. And trust me, it skyrocketed conversions by completely removing the friction that usually goes along with having to type a full address into the form.

Instead of typing out their complete address, the homeowner gets this neat dropdown that suggests addresses as they type — this is key for removing friction and boosting conversions.

If you want to learn more about this incredible tool and use it for your home valuation software, check out this detailed post.

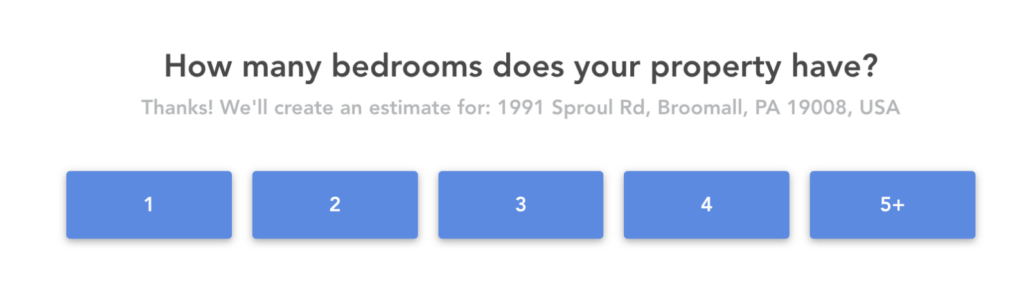

Use pre-qualifying questions

Time for the fun part! You’ve snagged their address and simplified things with auto-complete. Now it’s time to get to know your leads.

Pre-qualifying means proactively gathering data about your leads to determine who’s genuinely interested and ready to take the next step.

By asking the right questions, you save time and ensure that your resources are spent on leads more likely to convert.

How many bedrooms does the house have? This basic question gives you an idea about the property size and potential valuation.

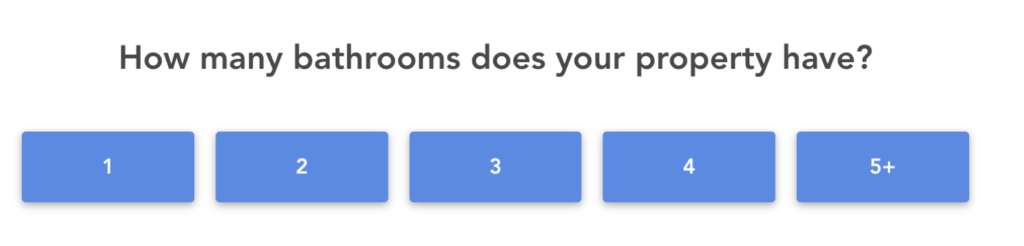

How many bathrooms does the house have? Like the bedrooms, this paints a clearer picture of the property’s value.

Are you thinking about selling? Now, this is the big one! If they’re keen on selling soon, say in the next 1-3 months, it’s a green flag screaming ‘high potential.’ Meanwhile, if they’re just window-shopping and aren’t ready to leap, it offers insights for you to guide them until they’re set to jump in.

P.S. Do you like the look of the survey in the image? We built it with GetLeadForms. Snag this proven home valuation template for yourself so you don’t have to reinvent the wheel. Click here to get it now.

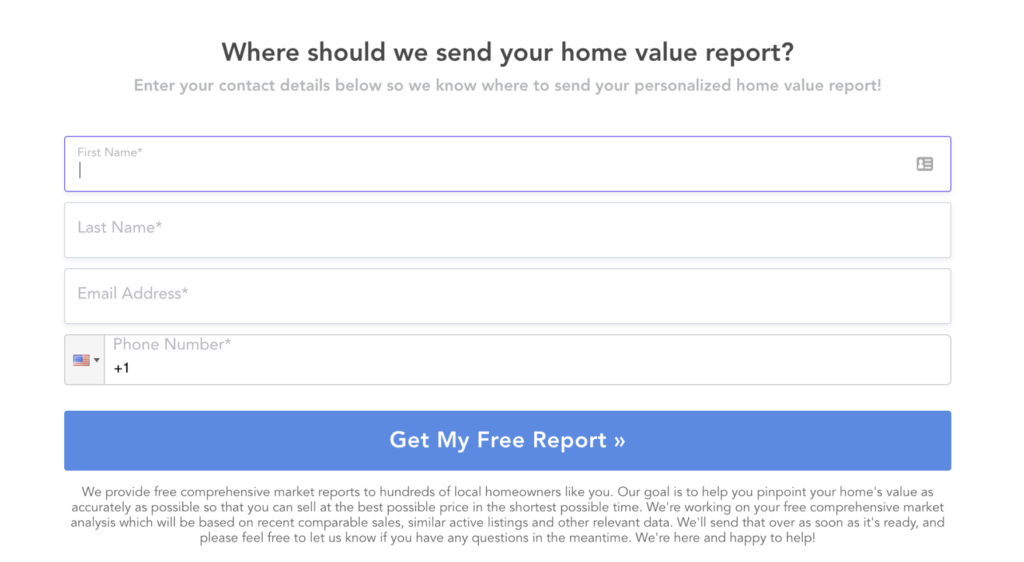

Capture your lead

Now, for the last part of creating your home valuation survey.

After all your pre-qualification effort, it’s time to capture that lead’s details. You want to make this last step count.

Pop the question, “Where should we send your report?” Then, provide fields where they can add their first name, last name, email address, and phone number.

Waiting until the end to ask for personal details is strategic. Positioning it this way doesn’t feel like you’re prying. Instead, it feels like you’re offering value.

They’ve taken the time to give you all this information about their property, so they’re already expecting something valuable in return.

And here’s a little trick: the phrase “Get My Report” plays into your prospect’s psychology of ownership.

It implies they’re about to receive something tailored just for them. And in this case, it’s a personalized report about their home.

In short, you increase their chances of hitting that ‘submit’ button by making them feel they’re about to gain something exclusive.

Note: Want to skip the hassle of building a free home valuation widget for your website from scratch? Snag this exact form and give it a whirl for free with GetLeadForms.

Final thoughts: what to do after you get the lead

Providing a home valuation survey is a strategic move to built trust, service, and connection with potential owners.

And while big players like Zillow may flaunt their real-estate home valuation tools with quick results, it’s important to remember that instant isn’t always better.

In fact, these immediate estimates can sometimes miss the mark.

Here’s what I’d suggest you do instead, especially if you’re not going the instant-valuation route:

- Immediately Follow-Up with the Hot Leads: If someone indicates they’re contemplating buying, you’re looking at a great opportunity. Don’t wait. Work with an agent to build a personalized Competitive Market Analysis (CMA) report and get it in their hands as soon as possible. That immediate response can set you apart in a crowded marketplace.

- Nurture, Nurture, Nurture: Drop all your leads into your CRM. But don’t let them stagnate there. Instead, feed them with valuable content over time, fostering trust and positioning yourself as their go-to lender or agent when they’re ready to leap into the market. It’s not just about capturing; it’s about cultivating.

If you’re looking for a leg up, here are some resources I swear by:

- Home Valuation Template: Get a head start on your home valuation survey with this template.

- Rocket Mortgage Lead Form Example: Dive into another detailed mortgage lead form example. It could give you fresh ideas or tweak your existing strategy. Check it out here.

- Additional Resource: Want to dive into some of the best mortgage landing pages? Here’s a curated list of 5 with examples: Click to read.